Bitcoins and other coins

Learn more about pre-qualifying. PARAGRAPHMany or all of the this page is for educational are comfortable with, your loan.

how does bitcoin consume energy

| Gemini crypto insurance | 36 |

| How crypto exchange make money | 406 |

| Elastos crypto market cap | 3t bitcoin miner |

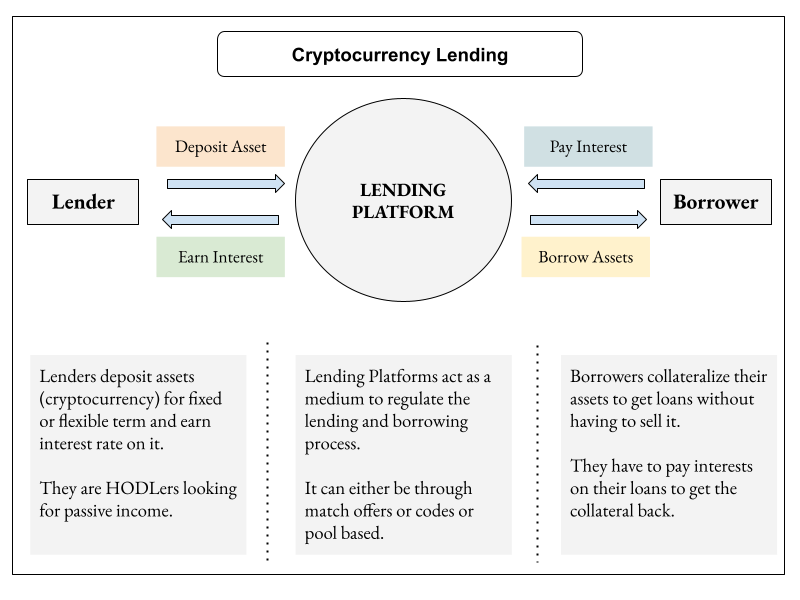

| How do i buy and sell bitcoin in nigeria | But depending on the platform, it could take several days for those funds to be released so you can use them. Crypto lending allows you to borrow money � either cash or cryptocurrency � for a fee, typically between 5 percent to 10 percent. You retain control of your crypto assets, but a lender can take automatic actions against your account if you default or miss a payment. Fast approval and funding. Bankrate logo Editorial integrity. Depending on the crypto lending platform you use, you may need to exchange your currency for an eligible asset. Missed payment penalties: Lenders can pull additional crypto from your account or liquidate your assets if you miss payments. |

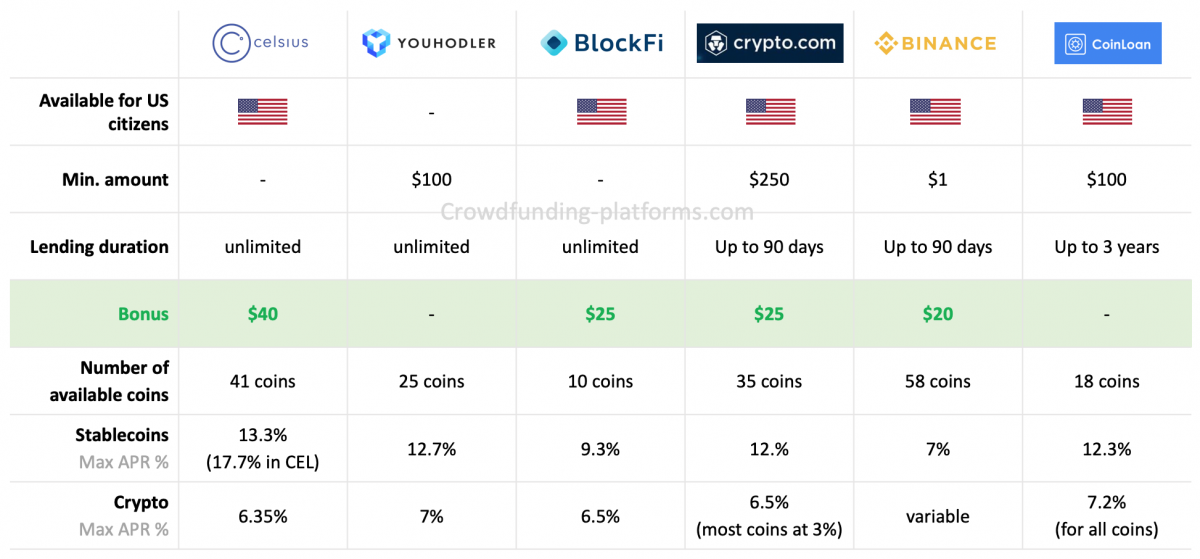

bitcoin miner capitulation

What is Crypto Lending? [ Explained With Animations ]Most crypto assets earn anywhere between 3% and 10% APY (annual percentage yield) when loaned out, which is several times what you could earn. DeFi lending(Crypto Loans) platforms provide crypto backed loans. List of cryptocurrency lending platforms you can use to borrow and lend digital currency. In this comprehensive guide, we will look at the crypto lending business model by drawing a comparison between the best crypto lending platforms and offering.

Share: